VA Home Loans

Blue Water Navy Veterans and Your Home Loan Benefits

Signed into law in June 2019, the Blue Water Navy Vietnam Veterans Act of 2019 provides service-connected disability benefits to many Veterans who served in the offshore waters of Vietnam, and in some cases their surviving family members. Blue Water Navy Veterans are now eligible for many VA disability benefits due to their exposure to a multitude of herbicides during their service during the Vietnam War.

In addition, as part of the Blue Water Navy legislation, Congress also authorized the following changes to the VA Home Loan benefit beginning on January 1, 2020 for ALL eligible Veterans:

- VA Loan Funding Fee Change - At this time, there is a temporary change to the VA Funding Fee, which is a congressionally mandated fee associated with the VA Home Loan. Veterans and Servicemembers will see a slight increase of 0.15 to 0.30% in their funding fee (currently for two years), while National Guard and Reserve members will see a slight decrease in their fee to align with the fee paid by 'Regular Military' borrowers (permanent). Veterans with service-connected disabilities, some surviving spouses, and other potential borrowers are exempt from the VA loan funding fee and will not be impacted by this change.

- Purple Heart - If you are an active duty Servicemember who has earned a Purple Heart, your funding fee can be waived if you close on your home while still serving on active duty.

- Conforming Loan Limits - Veterans will have greater access when using their no-down payment home loan benefit. Veterans seeking to obtain what are commonly referred to as "jumbo" loans, or Veterans living in higher-cost markets, will no longer be subject to the Federally-established conforming loan limit maximums. After January 1, Veterans may obtain no-down payment VA-backed loans in all areas of the country, regardless of home prices.

- Native American Direct Loan - The new law removes the loan limit of $80,000 for Veterans using their entitlement for a VA Native American Direct loan to build or purchase a home on Federal trust land. Eliminating the loan limit enhances access to home loan benefits for Native American Veterans.

Several provisions of the law interact to impact the cost for Veterans using their home loan benefits.

Beginning on January 1, the VA Funding Fee will increase for some Veterans, however, the effective 'cap' on VA no-down payment loans will be eliminated. Veterans paying a funding fee AND making a down payment should consider the costs associated with their situation. It may be advantageous to wait to buy or refinance a home until after the law takes effect on January 1, 2020.

Blue Water Navy Law, H.R. 299

Relevant VA Home Loan Comparisons:

Examples below encompass VA Funding Fee and potential down payments. Other fees assessed at closing (title, transfer, taxes, etc.) are not included and may also be accrued as closing fees.

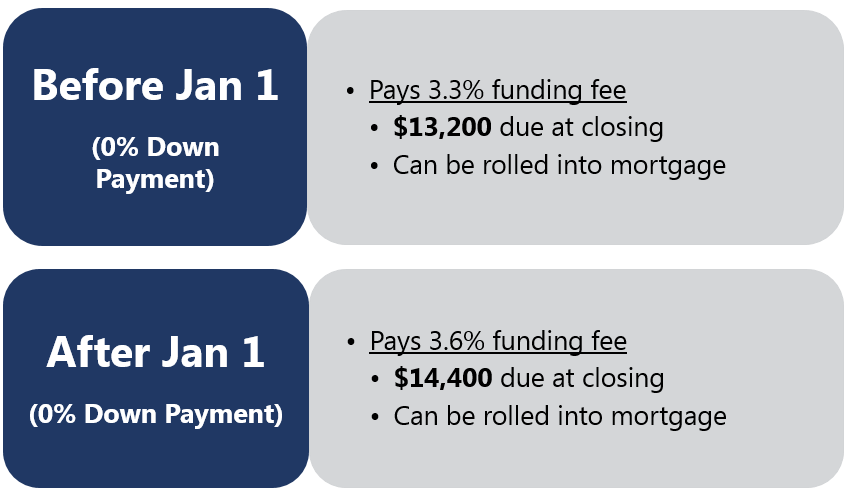

Borrower Case 1

- Active Duty Servicemember (second use)

- $400,000 home in Maryland

-

What does this mean for you? If you close before January 1st, you can save over $1,000 in funding fees.

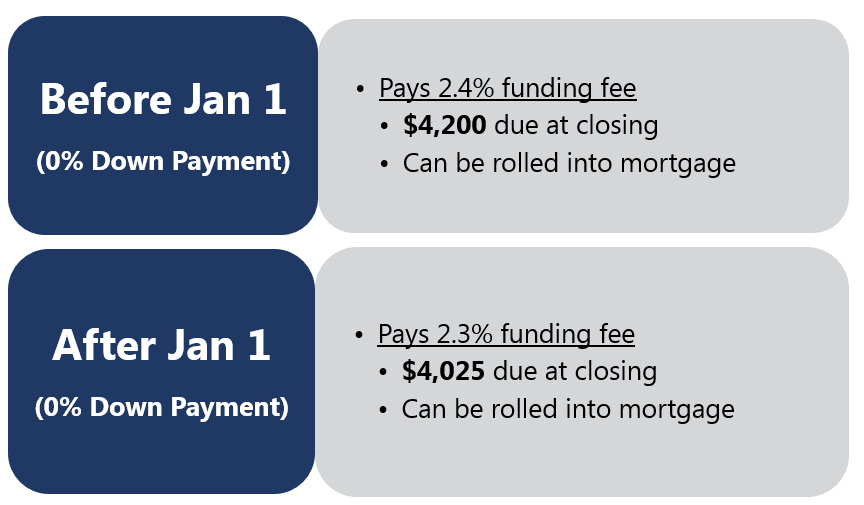

Borrower Case 2

- National Guard Veteran (first use)

- $175,000 home in Kentucky

-

What does this mean for you? There’s minimal difference in this example between closing on your home now, or next year.

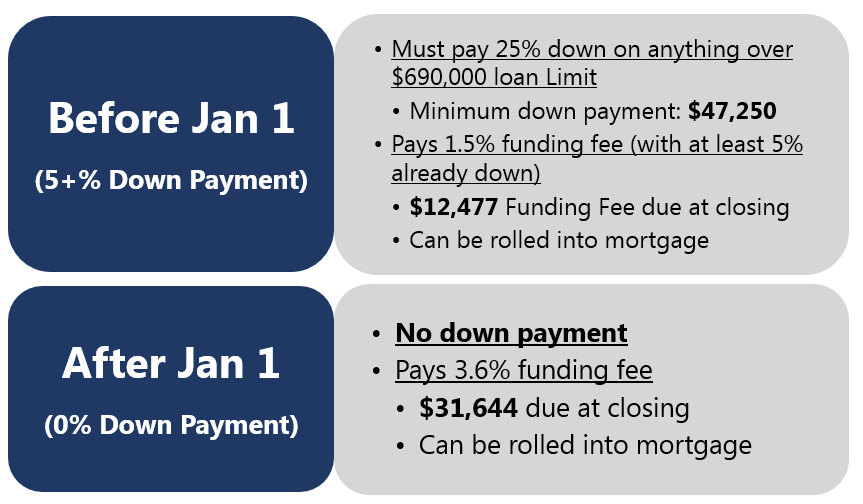

Borrower Case 3

- Active Duty Servicemember (third use)

- $879,000 home in San Diego, CA

-

What does this mean for you? If you want to use your zero-down payment benefit on a home that is priced above your county's conforming loan limit you must wait for the new law to begin. Something to consider is the funding fee rate is higher for any subsequent use, unless you are exempt from paying the funding fee. Although the Servicemember in this example will save nearly $30,000 in out-of-pocket costs upfront at closing after January 1st, the Servicemember will not have any equity in the home at closing. Therefore, if you can afford a down payment at closing, you could potentially save tens of thousands of dollars in fees up front, while building equity in your home and lowering your monthly mortgage payment.

-

Veterans in receipt of disability compensation at the time of closing may be exempt from paying the VA Funding Fee. Additionally, if you had a disability compensation claim pending at the time of loan closing and were later awarded service-connected disability compensation with an effective date retroactive to a date prior to the date of loan closing, you may be entitled to a refund of the VA Funding Fee. For more information, visit https://www.benefits.va.gov/homeloans/purchaseco_loan_fee.asp.

For more information on VA's Home Loan Program

PDF Documents — To read PDF documents, you need a PDF viewer. Links to viewer software can be found at this link.